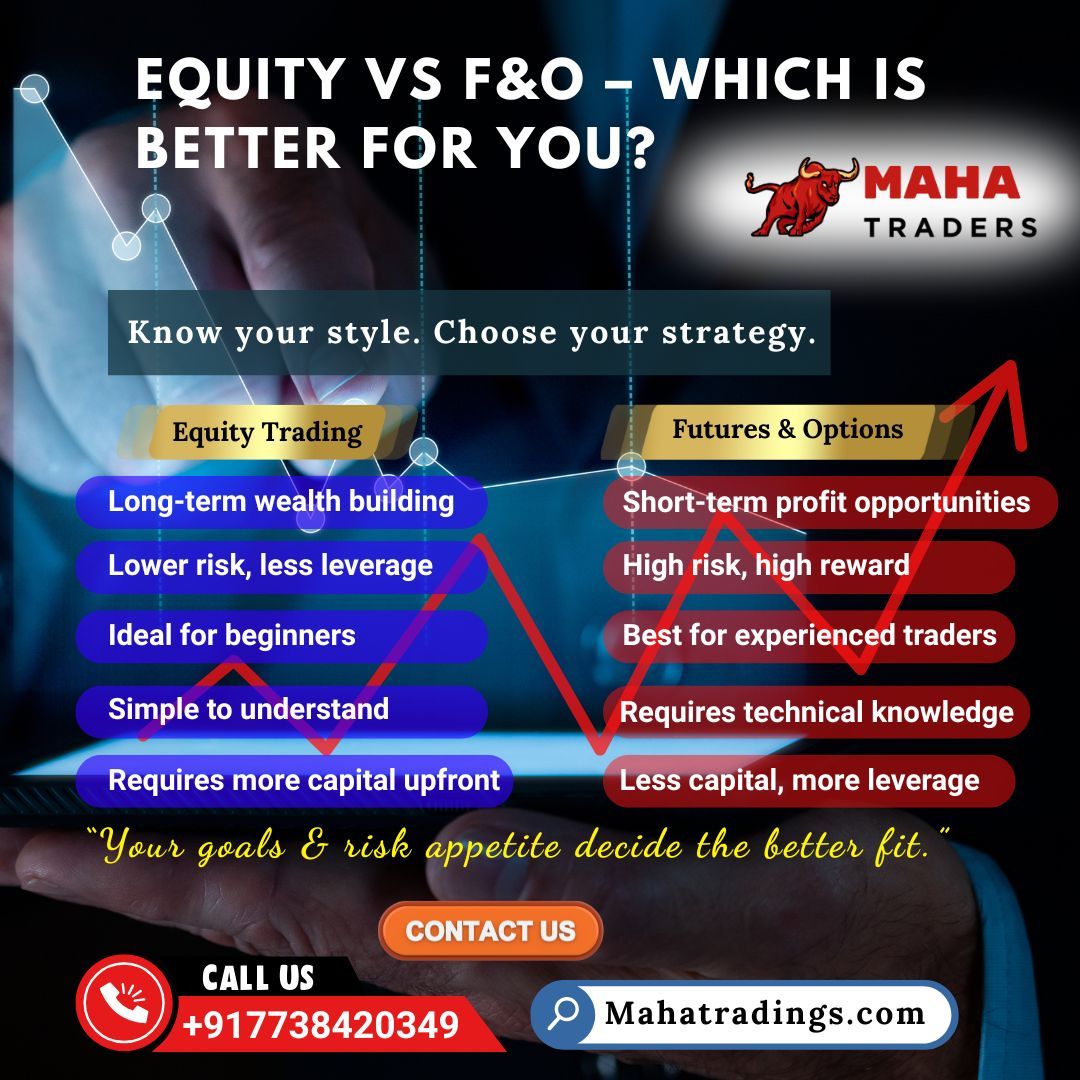

When entering the world of stock market trading, one of the most common dilemmas traders face is whether to go with Equity or Futures & Options (F&O). While both offer unique opportunities, they also come with different levels of risk, complexity, and capital requirements.

At Maha Trader, we help investors make informed decisions based on their goals, risk tolerance, and market knowledge.

Let’s break down the key differences to help you choose your ideal trading path:

🔷 What is Equity Trading?

Equity trading involves buying and holding shares of a company. It’s often viewed as a long-term investment vehicle where the focus is on building wealth steadily.

✅ Key Features:

- Long-term wealth building

- Lower risk, since you only lose what you invest

- Great for beginners looking for gradual growth

- Easy to understand — ideal for learning market fundamentals

- Requires more upfront capital compared to F&O

🔴 What is F&O (Futures & Options) Trading?

F&O are derivative instruments that derive their value from underlying stocks or indices. They are typically used for short-term speculation or hedging strategies.

⚠️ Key Features:

- Best for short-term profit opportunities

- Involves high risk, but also high reward potential

- Suitable for experienced traders only

- Requires in-depth technical and strategic knowledge

- You can trade with lower capital but more leverage

🎯 Which is Better for You?

It depends on your trading style, financial goals, and risk appetite.

SituationBetter OptionYou're new to the stock market✅ EquityYou want steady, long-term returns✅ EquityYou are an active, technical trader🔴 F&OYou’re comfortable with market volatility🔴 F&OYou have limited capital but want to trade big🔴 F&OYou prefer stable, compounding returns✅ Equity

🟢 Maha Trader Helps You Choose Wisely

We offer personalized guidance to help you decide the right fit. With data-backed strategies, technical insights, and real-time advisory, you can avoid guesswork and trade with confidence.

📞 Need help? Call us at +91 7738420349

🌐 Visit: MahaTradings.com

💬 Final Thoughts

There’s no one-size-fits-all answer when it comes to equity vs F&O. It all boils down to your financial goals and comfort with risk. Whether you choose stability through equity or fast-paced trading via F&O, always remember:

"Your goals & risk appetite decide the better fit."